Ways of Working115

Agility in the Mining and Resource Industry

Mining and Resource organisations are not exempt from disruption in today’s rapidly changing global economy.

Tahlia Oliver

September 6, 2020

Mining and Resource organisations are not exempt from disruption in today’s rapidly changing global economy.

Tahlia Oliver

September 6, 2020

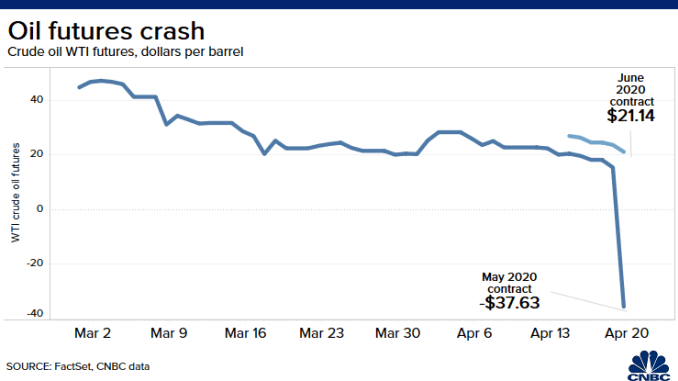

Mining and Resource organisations are not exempt from disruption in today’s rapidly changing global economy. For instance, the price of oil rapidly plummeted during the COVID-19 pandemic and was trading at a negative price in April 2020. This was due to the significant reduction in demand, resulting in excess oil supplies in such quantities that a lack of storage capacity has now become the primary issue.

While this pandemic is not an everyday event these organisations will face, it does highlight the importance for mining/resource organisations to be able to respond to market changes. For example, Iron Ore in 2020 has been at record highs, yet in 2019 Australian coal mines experienced the coal prices dropping to their lowest price in the last decade (dropping by a third). 2020 has not been the first time Oil has faced a rapid price drop either, with previous record lows being set in 2014-2016 due to oversupply. The price of oil then recovered and was trading at a high cost again between 2017-2019 before plummeting in 2020. Events like these trigger a “call to action” within organisations. Considering this, a focus on mining/resources Agility is expected to be a priority for organisations in this sector seeking better ways to navigate, pre-empt and respond to rapid change in the future.

Definition of Agility: Business Agility is the way an organisation can combine innovation, technology, ways of working and their organisational culture to not just respond or adapt to change, but to use change to their advantage when providing goods and services to their customers.

What is the goal of mining and resource agility: A key differentiator between mining and resource organisations and other industries (such as retail, digital services, telecommunications, banking/insurance) is the fact that they offer the exact same “product” as their competitors (the commodity, such as gold, coal, oil). The prices of these commodities are set by the market (based on supply, demand, and other geopolitical factors).

In light of the market that mining/resource organisations operate in, their focus or goal for Agility is to produce and provide the commodity to their customers:

| As quickly as possible | At the highest quality or grade | ||

| With the least amount of effort or highest efficiency (including maximising the site yield, extraction capacity and lifespan) | With the highest degree of safety or lowest degree of risk (particularly focussed on reduction in injury rate, increasing injury free days and avoiding fatalities) | ||

| With the highest degree of predictability and consistency | With a great degree of flexibility and adaptability | ||

| At the lowest cost |

At the lowest cost The mining and resource organisations who can achieve this will have the competitive advantage, allowing for higher profit margins and greater success.

Similarly to how Business Agility was a relatively new concept for banking and finance ten years ago, most mining and resource organisations are quite early on their journey.

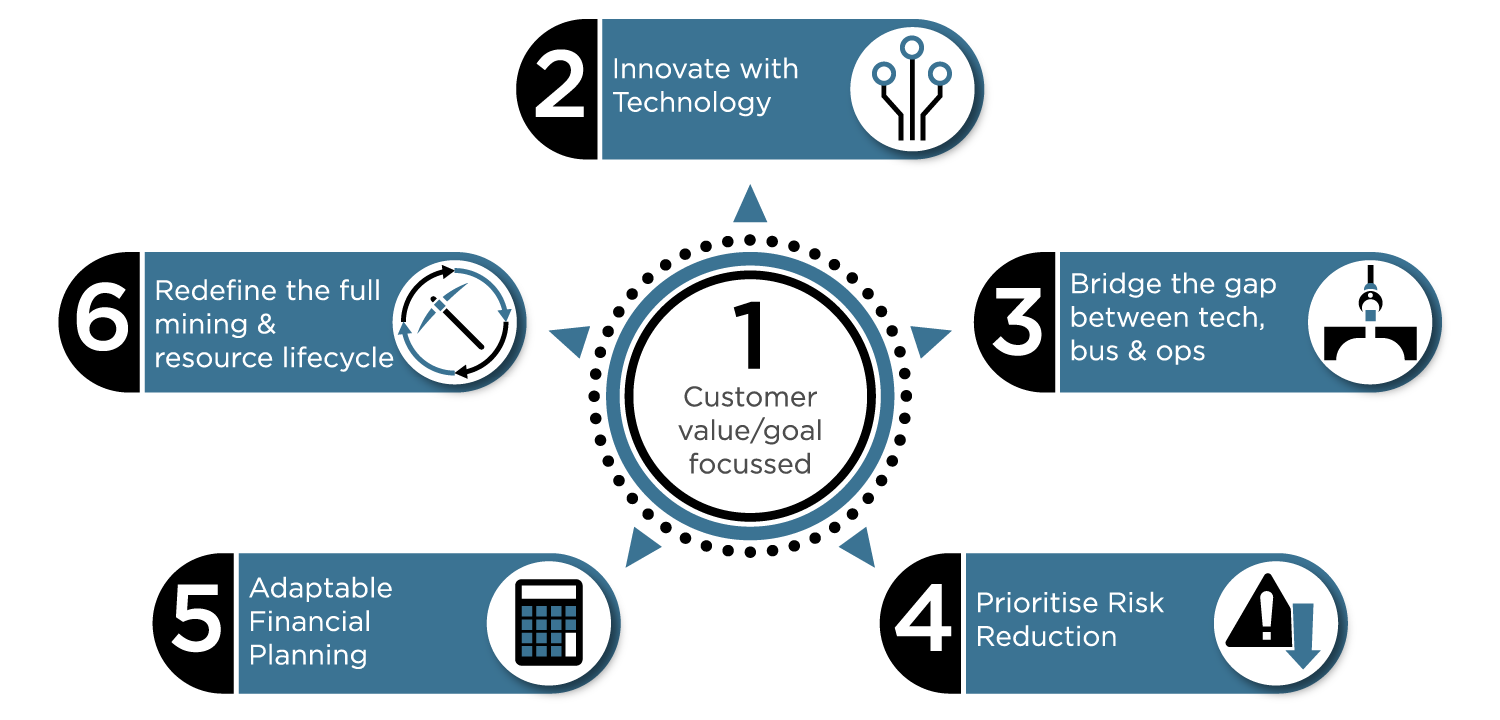

So, how can mining or resources organisations achieve Agility? While the mining or resources organisation of the future is still a concept that is evolving and being defined, these are some of the insights and observations from on the ground that can be adopted to enable success:

A fundamental principle for Agility and a differentiator for success is having the customer “at the heart” of all business decisions. Because mining and resource organisations are so large, the end customer goal can become lost in the many layers or steps in the production lifecycle, which similarly is the case in many other large organisations. The sole purpose for any organisation to exist is to serve and meet the needs of their customers.

The customer base of a Mining/Resource organisation differs significantly from that of most other industries, such as products and service-based industries like retail, banking and healthcare). Customers are fewer, but larger in scale.

The reasons customers buy from specific mining or resource organisations (or trader) also differs from other industries because of the highly regulated nature of the industry. Resources have a fixed price that is dictated by the global commodities market. As a result, the reasons for customers to buy from a specific company don’t tend to be driven by cost of product and instead are driven by other factors.

Customers instead buy from specific mining and resource organisations for the following reasons:

| Costs and efficiencies in receiving the goods from provider, e.g. shipping and transport, geographical location | Relationship with the provider, i.e. geopolitical relationships and trade agreements, political tensions, trust between the buyer and seller | ||

| Quality of goods received from the provider | Predictability, transparency and level of risk from buying from a provider | ||

| Regulatory, political and societal requirements and restrictions, e.g. ethical and environmental impacts have become key factors in who a customer buys from |

When intending to improve Agility, it is important that any changes adopted are done with the key objective in mind - “how do we enable our organisation and our employees to better meet our customer’s needs”.

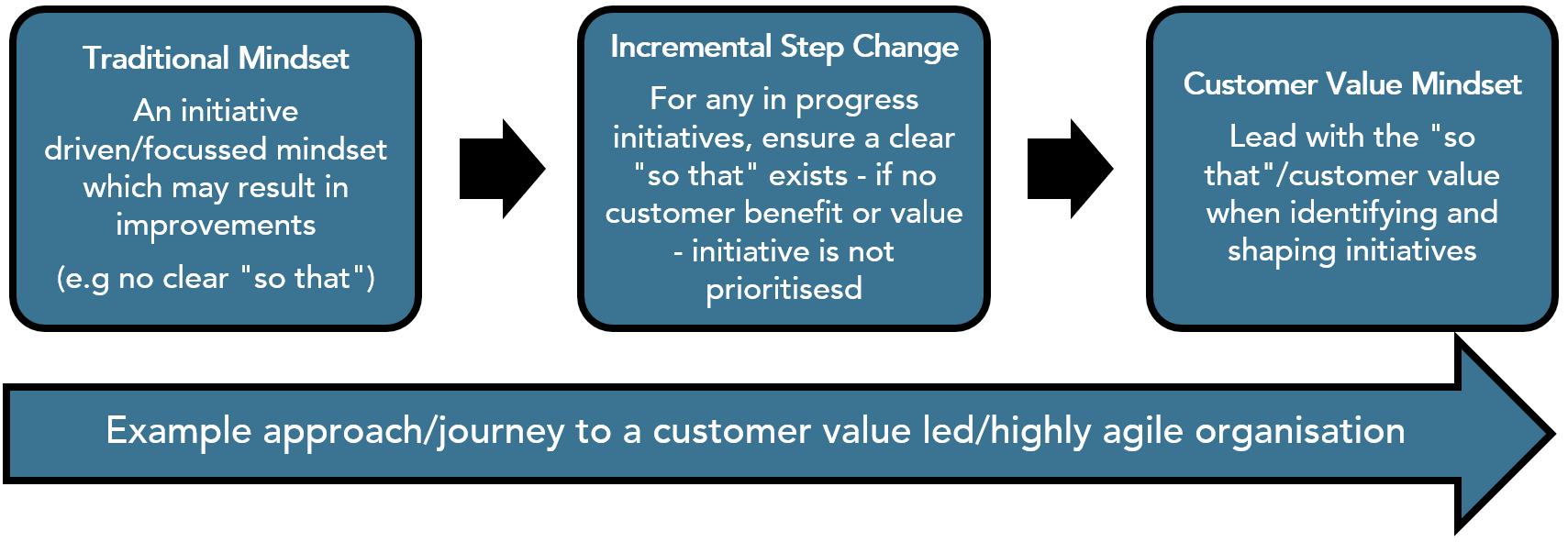

To begin shifting the mindset of employees from a “traditional initiative or project” mindset to a “customer value driven” mindset, the “so that” framework from a simple user story structure can be utilised for all initiatives and work being done, even all the way up to the strategic enterprise level initiatives. The end goal is to lead with the customer value in mind and design from a value-based focus and not an initiative or project-based focus. From experience, this can be a challenging mindset change for organisations and it may be more realistic to take an incremental approach by applying a “so that” structure to any in progress initiatives to embed this way of thinking.

If an employee does not have a clear understanding of the “so that” benefit to the customer, they should be encouraged to seek clarification and constructively challenge whether they are working on the right priority. Once all employees better understand the purpose of their work and the benefit they are providing to their customers, the mindset shift moves away from the work being a completion of tasks, to them contributing to the delivering of customer value.

A common mistake made in mining and resources industries when beginning on the journey is to confuse either stakeholders or different business units or teams to be “the customer”. An example of this is “IT or Business teams” remotely located in cities who see the “on site teams” as the customer. Another common example is for the organisation’s board to be treated as the customer. This is not the case. The customers for mining or resource organisations are always the purchasers who are buying the commodities. Without the buyers, the mine or refinery has no reason for existing. The “onsite teams” or board are not customers, but they are stakeholders (and in some instances end users of a solution to help them meet customer’s needs).

Despite not being the core reason for existing (i.e. providing commodities or resources to the customer), the stakeholders or users still remain critically important because of their role in providing the end customer value (i.e. producing the commodity). Particularly in the context of mining/resource organisations given their size and scale , as well as the broader implications the production lifecycle has, the needs of these broader stakeholder are critical and if not met result in cessation of mining/resource operations entirely.

The way to ensure stakeholders’ needs are met is to involve them upfront through co-design and ensure they are met before acceptance through inclusion in the definition of done.

An example is as follows: Using the same “good example” as above:

As a … Shipping operations duty manager

I want to … Receive notifications via a digital dashboard when processing times are not meeting required X tons per hour because of machinery issues or failures

So that I can … Prioritise operations teams maintenance schedules to focus on high impact issues to reduce shipping backlogs and delays to customers by x%

Example definition of done (or this is complete when) for a stakeholder might be:

Like any other modern organisation, the modern mining/resources organisation needs to rapidly adopt technology to change the way they operate, to remain competitive and to innovate. Organisations that do not rapidly adopt leading technology risk becoming redundant and this is no exception for mining or resource organisations. Additionally, in this space technology will become a major enabler for the adoption of many other principles to achieve Agility.

In the last five years there has been an increased focus on how these organisations innovate with technology, particularly using the following technology types:

Robotics and automation is typically understood to be a machine form of intelligence that is able to either assist or complete typically repetitive functions in place of human effort. This is one form of robotics and automation, but various other forms exist that can be applied in the context of a mining/resource organisation. These include:

These can be used to better track employee movements, health and safety, as well as productivity. These include:

Data is a critical asset that mining/resource organisations need to leverage to help understand the state of production and make informed decisions to ensure they provide maximum customer value. An agile resources/mining organisation should seek to utilise the data available from all sources, whether it be mining machinery, their employees, the market current state and potential future state. Data then can be utilised in the following ways:

When uplifting technology, the focus needs to be customer value led as highlighted above (refer to section 1. Understand the customer goal). A common mistake is to simply apply automation and/or digitised capabilities to the current processes or practices in the production/mining lifecycle. By doing this, it results in an unnecessary layer of technical overhead that now requires a team to support. This then raises an issue of who will manage these technical resources once they have become operationalised.

Bad example: Dashboards to visualise track number of truck driver incidents per month that resulted in employee injuries for operational reporting.

Good example: Complete automation of truck driver activities, removing need for manual effort on ground totally removing any occurrence of employee injuries related to truck driver incidents.

Instead, removing risk entirely is more valuable than just digitising/visualising the current risk and effort. This is done by re-imagining/re-inventing the experience or process, with the focus on the end goal/customer outcome and how technology can be applied to achieve this.

The more mining/resources organisations begin to innovate with technology, the more reliant operational functions will be on these technical capabilities to continue mining production and produce value for the customer.

A common reaction seen in mining/resources organisations embracing agility is the decision to immediately cut FTW/headcount when efficiencies are gained through automation or technology. Instead, organisations should redirect the effort saved through the efficiency gains into further automation adoption, capability uplift of their people and the management/maintenance of the technological assets. Automation and technological capabilities need to shift away from being seen as a “project”, to a strategic investment. The structure of the workforce will incrementally move away from the current labour intensive, hands on focus (with employees being heavily skilled in trades and physical/manual labour work), to a workforce skilled in automation, experience design, coding and development.

To begin this shift, the divide between onsite operational functions and office business/IT departments needs to be removed. Employees with technology skills should be embedded into the core operational teams onsite or remotely, working with the on the ground teams to develop and design new ways of working leveraging technology.

In a traditional mining/resource organisation, a large divide also exists between those making operational decisions regarding the extraction and production of the resources and the “onsite teams” responsible for the execution. This divide exists through multiple layers of management reporting hierarchy and geographical differences, as key decision makers are often based in global head offices. This means that those who are empowered to make decisions are typically far removed from the actual execution of mining/production activities. The further removed decision makers are, the longer the lead time required for decisions to be made and put into action, because information needs to travel through the multiple layers of hierarchy before reaching the decision maker.

An Agile mining/resources organisation brings the ability to make or adjust management decisions as close as possible to the people executing extraction and production activities. The intent is to empower those on the ground to make decisions that allow them to focus their time and effort in a way that maximises the customer value. For example, decisions about the location of extraction efforts based on the quality and quantity of commodity available.

In the existing way of working, the thought of allowing on the ground teams to make decisions typically reserved for senior management is one that may raise red flags, particularly because of the high-risk environment these organisations operate in. It is important to mitigate these risks when empowering teams to make decisions by ensuring they have the right knowledge, skills and capabilities required to make the decision.

To enable more adaptive decision making within mining/resources organisations, the following practical actions should be considered:

(not a “Spotify” or an “online store”)

Mining/resource organisations differ greatly from an online or Spotify type environment. In a Spotify type environment, you can experiment and if this fails the worst outcome is that the music service may stop working. In a mining/resource’s environment, the consequence if things go wrong can be as serious as the loss of life. That is why Agility faces a lot of backlash, particularly when it is applied without rigour and discipline. The approach to becoming an agile mining/resources organisation requires a strong focus on reducing risk through agile ways of working. Risk avoidance, risk reduction, health and safety must always be a key factor, prioritised in any decisions made in these environments.

These are some of the action’s teams can take, utilising the principles of Agility to reduce risk:

Even in the current ways of working, highly advanced controls exist for safety and when incidents do occur it often comes down to mistakes or human error. The principles for Agility mentioned above not only apply further innovative technologies, they also help address the human factors to improve safety.

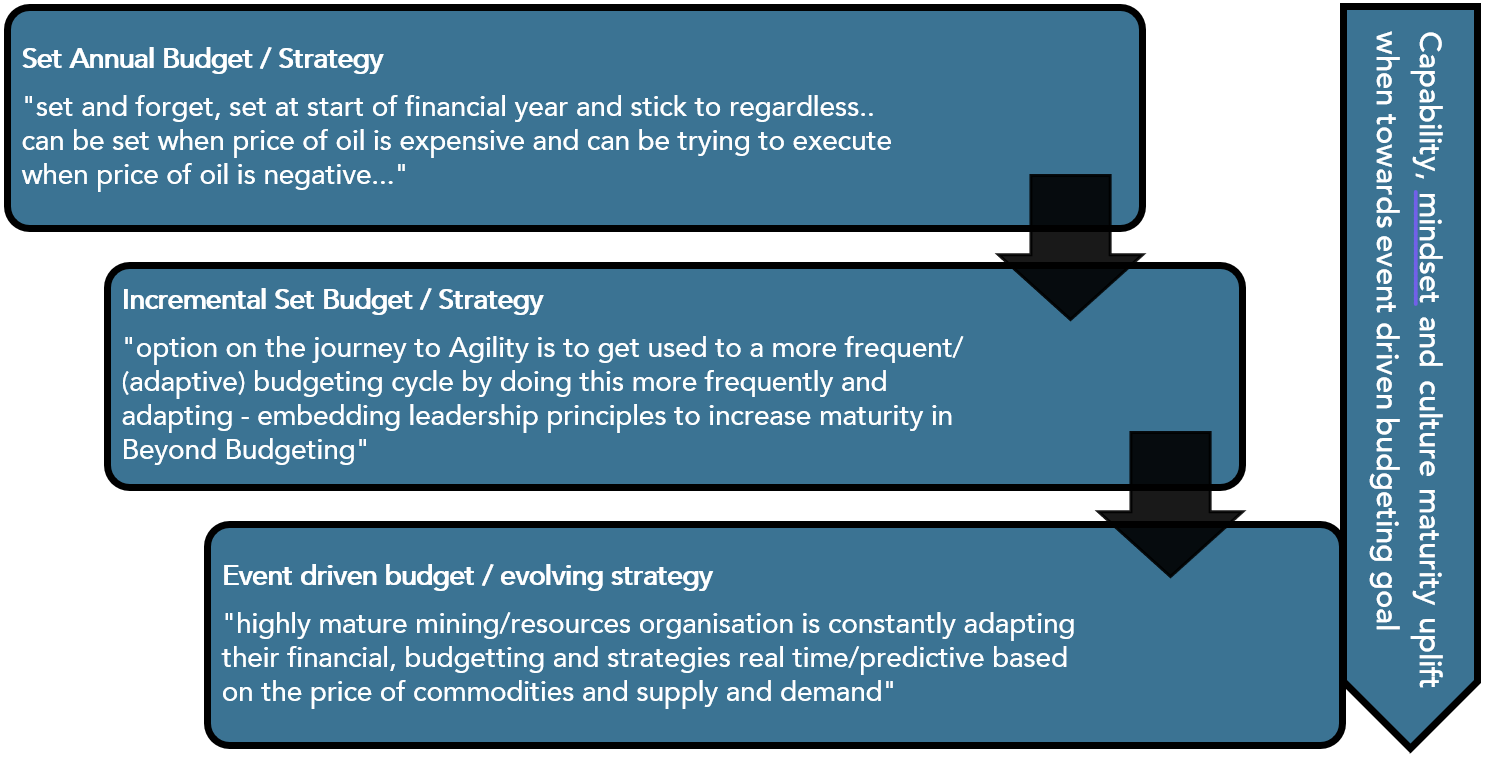

Traditional mining/resource organisations, like many other traditional organisations operate off an annual budget and longer-term strategy. These budgets are typically set based on detailed forecasting and modelling for production volumes and price of the commodity for the year, allowing for some variance in price. This is what could be referred to as a “set and forget” budget and strategy and unfortunately, companies who have taken this approach struggle to stick to their existing plan, particularly in circumstances like those of 2020.

In less than a month, between March and April in 2020 the price of oil dropped from roughly $50USD a barrel to around -$37USD. This drastic drop in the value of the commodity most likely means the organisation will not generate the revenue they planned to be able to allocate to staffing, projects or initiatives set out in their annual plan. The time spent (often months) modelling the annual budget, planning projects and allocation of funds is now wasted effort due to the change in commodity price making it all invalid. These organisations then typically find themselves in one of either two spots: struggling to try to stick to their existing financial plan; or rapidly trying to undergo the same process of replanning a full year based on the new figures.

A mining/resources organisation with a high degree of Agility does not set an annual budget or strategy. Instead they set targets/goals and objectives for their employees and adapt based on the latest/most current information and market circumstances. This means they have set objectives, but factors such as the budget is ever evolving based on factors such as the latest commodity price. If the price of commodities suddenly drops, similarly to how it did for oil in 2020, this would be a logical point for the organisation and employees to reassess the budget and goals to make crucial decisions on priorities for the organisation. Further events would be the trigger to continue to evolve and adapt the budget and plan.

Statoil leveraged this approach in 2015 when the price of oil rapidly dropped and moved away from a set budget/financial plan to an evolving model. This ensured that Statoil (now Equinor) was not only able to remain highly profitable, but they could continue to focus on the initiatives that provided maximum ROI in the market at the time.

The journey from annual planning to adaptable event driven planning is not easy. For organisations where the culture and mindset of Agility is a new concept, it may be more organic to move towards event driven budgeting or planning incrementally. To begin to develop the skills, mindset and culture that allows an incremental evolution into event driven budgeting, teams can approach this with two focus areas in mind.

(Redefine the full lifecycle for agility)

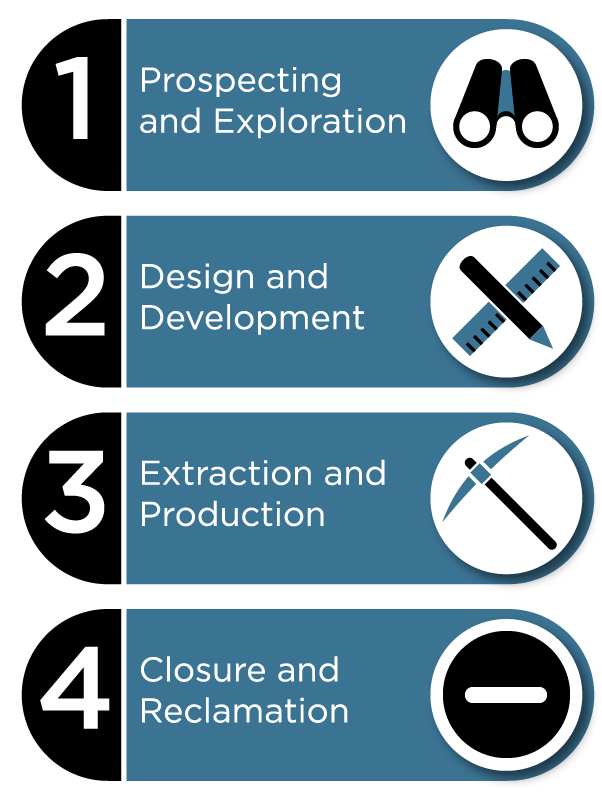

When considering the mining/resources industries, the focus typically is on the extraction phase, which lasts many years given this is when the commodity is being produced. As such, this phase is where the current focus for mining/resources Agility has also predominately been focussed to-date. The full mining/resource production lifecycle has many stages and currently each stage lasts many years.

The typical stages of a mining / resources organisation are:

To progress through these stages currently using traditional ways of working is a lengthy process that requires significant investment in funding, time and resources. Because the phases prior to extraction and production take many years to progress through, this large investment is required many years before any return is likely to be realised because return on investment only occurs once extraction or production commences.

The opportunity exists for new entrants and existing commodities organisations to disrupt the market if they can successfully apply the principles of Agility across the full lifecycle. Organisations that can rapidly progress or cycle through this lifecycle have a competitive advantage through reduced lead-time for return on their investment prior to the extraction or production phase. Additionally, the ability to reduce duration/lead-time required to get the commodities to customer allow for a more effective management of production based on supply and demand, reducing the impacts of events like the April 2020 oil price crash.

To avoid disruption by competitors, particularly new players in the industry, it is important that existing mining/resource organisations take advantage of the opportunities they have to safely experiment during their current production and extraction efforts. This opportunity to experiment will enable them to innovate, increase maturity and begin the mindset/culture shift required to improve their ways of working. This may prove to be the differentiator when new players or competitors come into the market and are looking to prospect potential mine sites.

Each of the key insights covered above is relevant and can be applied to each phase of the mining lifecycle. The new players will have the advantage of being free from legacy decisions, ways of working, technology or infrastructure, which gives them the ability to easily adapt and innovate across all phases of mining/resources lifecycle to achieve Agility. Existing mining/resource organisations should take full advantage of the opportunity they have to put these principles into practice to achieve Agility now.

While these insights and observations covered above are based on common challenges and opportunities seen across a number of mining/resources organisations, it is important to note that each organisations journey will be unique. Each organisation has unique employees, processes, technology and ways of working. Attempting a “one size fit’s all” approach to Agility is destined to fail. It is important to learn from other organisations, but when doing so, we must ensure we apply insights and learnings in a way that will enable customer value.

Providing customers value is the core reason mining/resources organisations exist. The reason for embracing Agility in mining/resource organisations is to maximise that value while meeting the organisational goals (covered in section “What is the goal of mining/resource agility”). A truly Agile organisation is one that is ever evolving and adapting, so this is a journey that will be ongoing over many years. It is important to not lose sight of the customer value, ensuring it is considered with every decision made.

- Tahlia Oliver

This paper is made available under the Creative Commons Attribution ShareAlike 4.0 International License. To view this license, visit http://creativecommons.org/licenses/by-sa/4.0/

This paper is made available under the Creative Commons Attribution ShareAlike 4.0 International License. To view this license, visit http://creativecommons.org/licenses/by-sa/4.0/

Please subscribe and become a member to access the entire Business Agility Library without restriction.