Transformation & Change108

Beyond Budgeting at tw telecom

Nevine White

March 14, 2019

Nevine White

March 14, 2019

As an operator of one of the country’s leading providers of managed networking solutions and lightning-quick fiber networks, it comes as little surprise that tw telecom’s forecasting implementation was quick and agile. Mark Peters, tw telecom’s executive vice president and CFO, also credits his company’s move to a six-month rolling forecast in 2004 with playing a large role in strengthening its overall business agility.

As an operator of one of the country’s leading providers of managed networking solutions and lightning-quick fiber networks, it comes as little surprise that tw telecom’s forecasting implementation was quick and agile. Mark Peters, tw telecom’s executive vice president and CFO, also credits his company’s move to a six-month rolling forecast in 2004 with playing a large role in strengthening its overall business agility.

“That’s one of our key successes: we’ve been agile,” Peters asserts. “In an environment that’s so competitive … things change so rapidly that if you are looking at a budget that was created two to three months ago much less nine months ago, it’s useless. Investments are higher or lower, something has changed, and your view has changed. The economy and the marketplace have inevitably changed as well.”

The company’s organizational dexterity was particularly useful both before and during the crushing recession of 2008 and 2009. Prior to the onset of the global economic crisis, tw telecom was first in its industry to “disclose that we saw issues starting to develop in the marketplace,” Peters recalls. “We were the first among our peers to say, ‘You know, there could be a tough time ahead… We are feeling some initial pressure from this recession, and this is how we believe it might impact us. We disclosed things sooner than most. And we think that as a result of this approach, we have built a significant amount of credibility on the Street.”

tw telecom’s disclosures to analysts and investors, like its forecasting approach as well the company’s other business processes, reflect a leadership philosophy that emphasizes the importance of being agile and responsive to current events, while managing for the long-term. This philosophy influences how the finance function is organized, the nature of the earnings guidance the company dispenses and all of its planning activities, including how and why it uses a rolling forecast.

“We don’t believe in managing to the short term,” Peters emphasizes. “If you manage for the short term, you’re not going to have a long-term. Obviously, you have to look tactically at the short term, but we’ve always looked at where we need to be one year, three years and five years from now. And I think that’s why we’re in such a good position today.”

This philosophy informs tw telecom’s approach to earnings guidance. The company does not give analysts guidance concerning its earnings, revenue, earnings per share or cash flow. Instead, tw telecom provides capital expenditure guidance (within an expected range), in part because these expenditures are fairly large in a capital-intensive industry (connecting fiber optics networks into businesses requires lots of capital costs).

The company also shares insights on key business trends, particularly those that influence pricing and demand as well as growth and other indicatives and directional near and long-term expectations on revenue growth and margin. Otherwise, Peters and his executive colleagues regard most forms of earnings guidance a trap -- one in which a company shares a prediction and then potentially uses unnatural short-term fixes to hit that number and avoid a negative response from Wall Street -- that they have strived to avoid.

“To say, ‘This is what the number is going to be next year or next quarter,’ is not as relevant as talking about the trends that we’re seeing in our business,” Peters explains. “We don’t know with certainty what our results are going to be in any given period. But we can explain what we see as the trends regarding our enterprise and carrier business, overall revenue, pricing, demand and cost trends, and what we are feeling from the economy in this environment.”Organizational Structure: Embedded Finance

tw telecom’s leadership philosophy also affects how the finance function is deployed. To keep business unit managers focus on hitting long-term objectives while also managing short-term challenges, the company has deployed corporate finance managers and staff in business operations throughout the country.

“The finance department gets embedded early on in evaluating how we are going to work with the customer,” Peters explains.

That means finance directors ensure that sales and other operational leaders understand the rules of engagement “so that we’re not reacting our way through each deal,” Peters explains.

“We don’t want to be in a position where suddenly a product has been sold and we have to play catch-up to figure out the pricing or return rules -- or how we make money.”

Instead, the embedded finance teams help sales and operational leaders remain focused on where and how corporate strategy indicates the company should drive business growth. “That’s a big component of why we have been successful,” Peters notes.

“Our finance team truly understands the business.” Finance needs to be well-versed in the technically complex products and services tw telecom provides to customers to ensure that the company turns a profit on its capital deployment.

This explains why the finance team has established an internal rate of return (IRR) model that serves as the litmus test for committing to a sale. The entire sale team understands what an IRR is. Sales also understand that the established (by finance) return threshold must be achieved before the company will commit to deploy capital to connect customer’s building. This consistently communicated objective helps the company focus on pursuing the right deals and the right customers, and reduces the time, money and energy wasted on sales that do not generate a positive return.

“Because of the training, processes and return thresholds, the IRR conversation has become part of our corporate DNA, and as a result we’ve shortened our goal and budget process,” Peters notes. “Ultimately, we are here to return shareholder value, and the way you do that is to get a return on the investment, whether it’s in infrastructure, product or people. That’s a given in our organization.”Mandate: ‘Find a Better Way’

The finance organization is involved with the one-year and multi-year strategic planning and development, and it’s involved in creating the communication process, as well. This role helped green-light a somewhat unorthodox request nearly seven years ago. On the heels of the dot.com and related telecommunications crash of 2001-2002, tw telecom’s traditional budgeting processes sparked the same frustrations that most traditional budgeting processes spark when there is any amount of economic volatility in the air.

“The budgeting process had turned into an exercise where everybody was putting together a huge spreadsheet that contained this, that and the kitchen sink,” Nevine White, tw telecom’s vice president financial planning & analysis, explains. “And then we'd come in ridiculously high relative to what our CFO’s expectations would be from the perspective of a financial understanding of what the business can sustain regarding such things as costs and growth cycles … We would have these horrid budget meetings … followed by iteration after iteration resulting from extremely frustrating and unproductive meetings.”

All of this effort produced a budget that the board approved in early January. “And by the end of January,” White adds, “it was essentially obsolete.”

So, the executive team issued a challenge: Find a better way. In March 2004, the finance function proposed a move to a rolling forecast. A few months later, by mid-2004, the CEO and senior executive team has agreed to give rolling forecasts, in lieu of the traditional budgeting process, a try. “It wasn’t an easy decision because it was such a different approach,” says White. “Everybody was used to preparing and approving an annual budget. We went down this new path because the annual budget was just so frustrating. You spend three months doing it — you probably start in August or September to prepare the budget for the next year — and inevitably by the time you’re done it’s old news. It doesn’t provide a foundation for an agile company … When you have to manage to that stale budget throughout the whole year, it becomes worse than useless. The budget becomes destructive. We knew we needed to do something different.”Implementation: Rapid and Thorough

As tw telecom’s implementation demonstrated, it is possible to do something different quite quickly. After receiving approval to implement rolling forecasts in late spring 2004, the process rollout began in late summer of that year, and the first cycle of forecasts were completed in early autumn. The speed and effectiveness of tw telecom’s implementation was possible due to four factors:

The executive team worked diligently to convey several important messages about the shift away from the traditional budgeting process to rolling forecasts, including the following:

From a change management perspective, the finance team conducted a fairly comprehensive change readiness assessment. The assessment measured the degree to which employees in the field and at corporate headquarters: (1) understood the transformation’s goals, intended benefits and documentation; (2) knew how and where to get help; (3) could apply the results of the rolling forecasts to their jobs; and (4) witnessed a high level of executive sponsorship among other measures.

The change readiness assessment helped the implementation team assess gaps that cropped up and, equally important, target training and communications to address any areas of confusion. The training and communications effort also qualified as comprehensive. The implementation team visited all of the company’s regional offices to conduct in-person meetings in which they explained the rolling forecast concept and how the process would work.

“The team talked a lot about understanding the drivers and how we would roll the forecast up,” White recalls. The company conducted workshops focused on rolling forecast processes and tools, and published a custom guidebook with three sections: Concepts and Theory, Forecasting Application and Forecasting Process. (During the first two years following the initial training, tw telecom refreshed the training materials every quarter to better support the employees’ needs as their understanding progressed.)

The company’s focus on managing change during the implementation helped address several challenges (see “Obstacles to Overcome” side bar) and, White notes, ultimately produced the following benefits:

Today, tw telecom completes a rolling forecast (two quarters ahead) four times a year and provides updates to C-level executives on a quarterly basis. Field business units forecast 45 line items while corporate departments forecast 18 line items. The board of directors receives an annual summary along with interim updates, as needed. By embedding finance throughout operations, tw telecom helps ensure tight alignment between company strategy and business objectives on key initiatives as well as from an ongoing, daily performance perspective. Plus, the forecasting process marks a dramatic improvement over the previous, traditional budgeting approach, according to White.

“We now complete a rolling forecast four times a year, which takes less time to complete than how we previously conducted our budgeting process once a year,” he explains. “We don’t go through every single line item, like we used to. Instead, we have aggregated the data, based on trends. Why do you need hundreds and hundreds of lines when each item doesn’t move the needle enough to matter?”

Finance and operations managers have reallocated their time – previously spent on numerous rounds of back-and-forth negotiations that the traditional budgeting processes demanded – to higher-return activities.

“Our people spend more time running the business rather than worrying about insignificant budget variances,” Peters continues. “And for those who are responsible for updating the forecast, it is very much routine. We’ve followed this rolling forecast method since the end of 2004, so we have a rhythm going. The accuracy improves every single time … and the pain level is so much lower.”

The greater accuracy Peters describes has also helped enable the organization to redefine accountability. The accuracy improvements come, in large part, from the ongoing comparisons of actual results to the bottom-up forecasts. The finance team can see, for example, when the field has been more optimistic than the actual results, or when the field has been more pessimistic. By generating this trend information, the corporate finance team can modify forecasts as needed. If a business unit consistently underestimates in its forecast, corporate finance can take two steps.

First, it can apply a “governor” (plus x percent) to a specific forecast.

Second, corporate finance can hold meaningful discussions with the business unit manager about consistently generating in accurate forecasts.

“Now, we don’t go to our managers and say, “Wait a minute, you had this number and you missed it, what’s going on?” Peters explains.

“We sit with them and say, ‘Here’s the variation from the number that you expected, let’s talk about why that happened.’ We have a conversation about the trends in the business.”

Those discussions focus on root causes. The region or city the business unit is responsible for may have a talent issue – or a new competitor.

“We have achieved much better accountability,” Peters adds, “even though we update the forecast every single quarter.” This accuracy and accountability has helped tw telecom become more agile than ever.

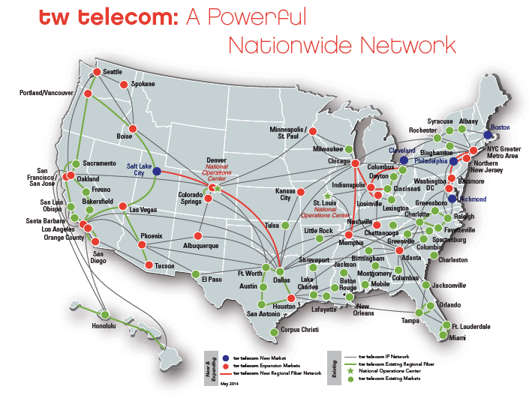

tw telecom was headquartered in Littleton, Colorado, and a leading national provider of managed services, including Business Ethernet, converged and IP VPN solutions for enterprises throughout the U.S. and globally.

On October 31, 2014, Broomfield, Colorado, based Level 3 Communications, Inc. announced it completed its acquisition of tw telecom. With most of tw telecom’s executive team not continuing on with the combined companies, many of the innovative planning processes that had been in place for the past decade were absorbed back into more traditional financial constructs favored by the acquiring-company’s management team.

Subsequently, Level 3 Communications was acquired by CenturyLink on October 31, 2017.

Littleton, Colo.,-based tw telecom has achieved the following benefits from its transformation from a traditional budgeting process to a rolling forecast:

Despite the speed of tw telecom’s implementation effort (less than six months), the company encountered several challenges it needed to address – swiftly and effectively – during the rollout. One of the biggest challenges related to accountability, notes Executive Vice President and CFO Mark Peters.

Under the traditional budgeting process, managers were held accountable if they missed a number (e.g., hired too many people) even if the assumptions on which the budget was based were wrong. While that form of accountability is inherently flawed, managers had grown accustomed to operating that way.

Fortunately, frustration with the traditional budgeting process helped overcome the shift to a healthier form of accountability. Peters and tw telecom Vice President Financial Planning & Analysis Nevine White, identify four primary challenges the implementation effort successfully addressed:

Copyright (c) 2018, Live Future Ready

Please subscribe and become a member to access the entire Business Agility Library without restriction.